Have you caught wind of the excitement around building fourplex in Toronto? It’s not just wishful thinking anymore—it’s quickly becoming a reality, and the numbers are adding up better than ever before.

If you’re curious about why developers are shifting their focus from luxury homes to fourplex builds, what’s involved and how the numbers work.

Get ready because we’re diving deep into it in this video!

Why Build Fourplexes In Toronto?

Let’s talk about why there’s a lot more buzz around fourplex builds lately! First, it’s now doable thanks to zoning changes in Toronto.

Last year, in 2023, Toronto gave the thumbs-up to new zoning rules, letting every home in the city have up to 4 units plus a backyard house.

Another big change? Parking requirements got tossed out, freeing up more space on properties. This move is especially helpful for the smaller lots in Toronto, making it feasible to fit in 4 units.

Plus, the cost of construction is becoming more appealing. Development charges, usually around $50,000 per unit, are now waived for up to 4 units. If the backyard house is the 5th unit, its development charge can be postponed for 20 years.

Another big thing that’s attract clients to new builds is the fact that new units aren’t rent controlled. With market rents coming up quickly because of our housing crisis and the fact that the gap between existing rents and market rents are expected to widen, non-rent controlled units look even more attractive.

How To Finance A Fourplex Build In Toronto

In terms of financing, you can aim for a down payment as low as 20% when you make the purchase.

When it comes to building, you’ve got choices such as construction financing, a line of credit, or other private funding. Some investors even use cash if they have it available due to the current higher cost of capital.

Once that’s sorted, you have various exit strategies. Sure, you can sell and cash out, but you can also rent the multiplex out and refinance, which sets this approach apart from developer’s traditional approach to build luxury homes for sale.

This way, developers can keep enjoying the benefits of long term appreciation and rental income after putting in the initial effort.

When it comes to refinancing, you can still secure residential refinancing for 4 and 5 units with a major bank.

Alternatively, you can opt for CMHC’s MLI Select financing if you have 5+ units and qualify for lower rates, a higher loan-to-value ratio, and a longer amortization period.

How To Value A Fourplex

It’s much easier to figure out how much the property is worth after it’s built. Luxury homes can be worth a lot when the market is good, but if there’s a recession, their value can drop dramatically—basically, they’re more affected by emotions.

With rental units, it’s simpler: you just look net rents and market cap rates to get your value. So, it’s easier to predict how much your investment will grow, especially making the project less risky.

The returns often add up quite well, which is why more clients are jumping on board with this approach. However, it’s not a fit for everyone, naturally.

It requires a significant amount of capital upfront and it will be tied up for a couple years. These clients are actually financing this with cash and opting for a lower LTV to lower their investment risk.

You also need to be ready to take on the risks of development because it’s a huge undertaking—you’re demolishing a house and converting it into a mini-apartment complex!

Returns & Cash Flows On A Fourplex Build In Toronto

Let’s take a closer look at why clients are heading in this direction with the numbers.

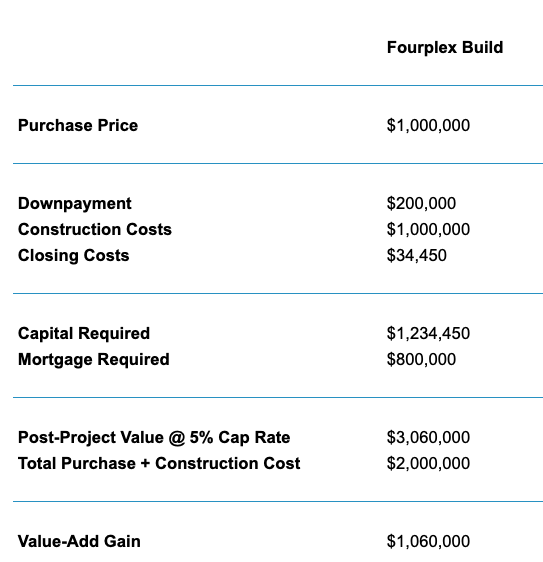

A typical starting point in Toronto is buying a bungalow for about $1M.

Then, we add on and turn it into a fourplex, which might cost another $1M to build.

After it’s all set up, the total monthly rent for all four units is around $15,000. Subtracting operating expenses leaves us with about $12,750 per month or $153,000 per year in profit.

Using a conservative estimate of a 5% cap rate for multi-family properties, the post-construction value of the property jumps to $3M—giving us a $1M gain from the fourplex build.

Instead of selling to cash out, let’s say we refinance the property with a conventional residential mortgage, pulling out $2.4M, which covers our initial investment and leaves us with an extra $400,000 in cash. Plus, rents can still cover expenses and the mortgage payments, so that you can comfortably continue to build equity with each mortgage payment, and benefit from the property’s long-term value increase.

If we also build a backyard house and then refinance it with CMHC’s MLI Select program, we might get even better terms—like lower interest rates, longer payment periods, and the ability to take out even more cash for future projects.

One Fourplex vs Severing & Making Two Fourplexes In Toronto

Let’s take it a step further. If building one fourplex makes sense financially, wouldn’t dividing a bigger lot and building two fourplexes be even better?

Well, finding wide enough lots in Toronto for this is pretty rare for starters. Sure, the potential returns could be higher. Let’s say the lot might close 50% more, and when you break it down per unit, it becomes 25% less. You still earn similar rents per fourplex, so you can potentially get better overall returns.

But, there are some things to think about. Even if you find the right lot, you’ll need a lot more money for a project like this.

You might end up needing a lower LTV because of the higher value if you are tapped out on the qualifications die. Plus, building two fourplexes means you need a lot more construction dollars.

Here’s the big one: there’s a lot more uncertainty, which means more risk. There are unknowns about dividing the lot, holding costs, and extra charges for the process.

So, if you’re new to this, it might be safer to start with just one fourplex build to chances for your project’s success – which is honestly already really amazing.

How We Can Help

If you’re interested in learning more, our team is ready to help! We’ve been helping more and more clients find properties perfect for building multiplexes in Toronto lately – we know what to look for to make sure you get the best returns with the least risk.

Plus, we have architects who can check if your plans are doable, can help with rents, cash flow, valuation projections, and connect you with reliable trades and builders so you can build your A-team.

If you want to discuss your private real estate situation with us, just go to this link below to set up a time to chat!