If you’re looking into Toronto real estate investments, chances are you’ve stumbled upon the term “cap rates.” Let’s unravel the mystery—what are they, why do they matter, and why the standard calculations might not tell the whole story? Let’s break it down!

What Is Cap Rate?

Cap rate, or capitalization rate, provides a gauge of the rental income we earn from leasing an investment property. Real estate investors like it because it helps compare how well a property’s rents are doing compared to others.

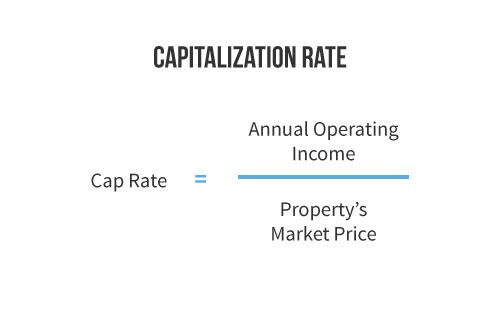

How is Cap Rate Calculated?

To find the cap rate, you divide the yearly money you make from renting (called annual net operating income) by the property’s value.

The net operating income is the rent you get minus costs like utilities, insurance, property tax, condo fees, maintenance, and accounting for vacancies.

Key Considerations

- No Appreciation Included: Cap rate disregards property appreciation, so always check total returns, including appreciation, for a holistic view.

- No Mortgage in the Mix: Cap rate excludes mortgage costs, a vital factor in risk assessment. Higher leverage may mean better expected ROI but comes with increased risk.

- Use Current Market Value: Base cap rate calculations on the property’s current market value for accuracy, especially if purchased years ago.

- Renovations Matter: Consider the actual market value post-renovation, not just the renovation cost, to avoid inflated cap rates.

In essence, cap rates offer insights into an investment’s rental income potential. However, a word of caution—use it as part of a comprehensive analysis, considering property appreciation and real market value for informed investment decisions.

What Are Typical Toronto Cap Rates Today?

Cap rates depend on interest rates.

If it’s more expensive to borrow money, investors want higher cap rates to make their investments worthwhile. This adjustment in the market can happen by lowering property values, raising rents, or both.

Typical Toronto Cap Rates (as of November 2023):

- Toronto condo cap rate is at 3-3.5%

- Toronto single family home cap rate is at 3.5-4%

- Toronto multi-family home cap rate is at 4.5%+

- Toronto accessory dwelling unit cap rate is at 8%+

What Is A Good Cap Rate?

We prefer low-risk real estate investments and aim for at least break-even cash flows.

Ideally, we want a bit of positive cash flow after covering the monthly mortgage, allowing us to add to our emergency fund or handle unexpected expenses. We’ve seen how crucial this is as interest rates rise.

It’s not straightforward because when interest rates are lower, the percentage of the mortgage payment that goes toward the principal is higher. So, to break even, you need a bigger buffer on the cap rate above the interest rate.

When rates are higher, the principal paydown percentage is lower, requiring less of a gap between the cap rate and interest rate.

As of January 2024, we are aiming for a 5.5% cap rate to break even.

Improving Cap Rates: Strategies for Investors

You can make your investment returns better by getting more rent on the property, such as:

- upgrading a unit

- adding more bedrooms to a unit

- increasing the number of units in a house

- adding a backyard house

How To Make A Multiplex In Toronto: Your Complete Guide!

Insights for Toronto Real Estate Investors: Additional Considerations

If you’re diving into Toronto real estate investing, there are some important things to know:

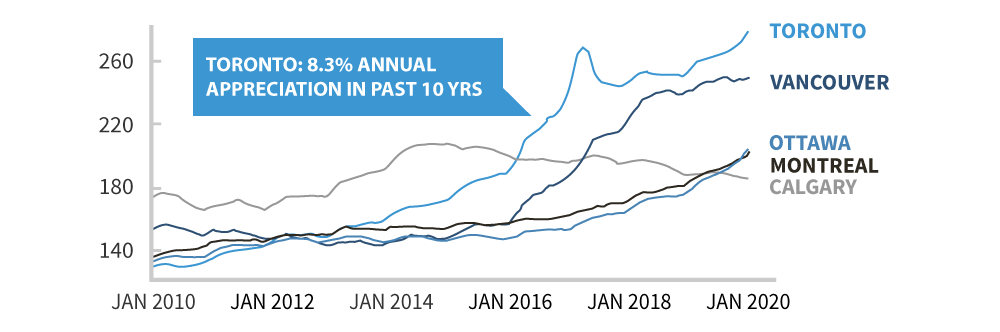

City and Property Differences: Cap rates (a measure of investment return) can be different for various property types and cities. But here’s the scoop: Toronto is a standout. The city’s real estate appreciation tends to be better and steadier compared to other places in Canada. So, when you’re figuring out your strategy, consider Toronto’s strong appreciation as a big plus.

Learning from Toronto Condos: Toronto’s condo market teaches us a valuable lesson. Condos might seem like an easy win with high growth in the mid 2010’s, but here’s the secret: balancing that potential with better cap rates in Toronto houses is a smarter move – aiming for lower risk and better long-term returns.

Neighbourhood Matters: Fancy areas might have lower cap rates because they cost more to get into. But hold on – these spots often give you more stability appreciation. It’s a bit of a trade-off, but it can be the right choice for someone looking for a safer Toronto real estate investment.

Value-Add Gains: Thinking about sprucing up an older Toronto home? Smart move! Renovations don’t just pump up your rental income; they also speed up the increase in your home’s value. With Toronto’s array of older homes, there’s many potential value-add projects waiting for you.

How We Can Help

If you’re feeling a bit overwhelmed about where to put your money in the real estate game, don’t worry – we’ve got your back! Our experts are here to understand your goals and help you find the ideal investment property.

Just hit the button below for a free 30-minute call with our Toronto real estate investing team!

What Toronto Real Estate Investment Is Right For You?

Check out our complete Toronto real estate investment guide for all the details and real-life examples. If you’re ready to dive in, just book a call with us!

mia chenJune 14, 2024.We had the great pleasure of working with Nick to purchase our first house, and we were absolutely thrilled with our experience. His expertise and attention to detail were evident, and he guided us through every step of the way and answered any questions we had. He was always genial, punctual and gave prompt responses. We appreciated how he took the time to understand our specific needs and preferences. His knowledge of properties, of neighborhoods and of the market helped us find the house we wanted in just a couple weeks. Moreover, Nick has an extensive network of reliable professionals: the inspector, lawyer and contractors he suggested made us feel safe and secure in purchasing our house and turning it into our home. We are thankful to not only have an agent with exceptional professional acumen from whom we learned a lot, but also a friend who took care of us and celebrated each milestone with us. We wholeheartedly recommend Nick and the team at Elevate.

mia chenJune 14, 2024.We had the great pleasure of working with Nick to purchase our first house, and we were absolutely thrilled with our experience. His expertise and attention to detail were evident, and he guided us through every step of the way and answered any questions we had. He was always genial, punctual and gave prompt responses. We appreciated how he took the time to understand our specific needs and preferences. His knowledge of properties, of neighborhoods and of the market helped us find the house we wanted in just a couple weeks. Moreover, Nick has an extensive network of reliable professionals: the inspector, lawyer and contractors he suggested made us feel safe and secure in purchasing our house and turning it into our home. We are thankful to not only have an agent with exceptional professional acumen from whom we learned a lot, but also a friend who took care of us and celebrated each milestone with us. We wholeheartedly recommend Nick and the team at Elevate. umang shahJune 5, 2024.KATE's dedication and hard work during the house-hunting process were outstanding. The entire process, from our first meeting to moving day, was easy and stress-free. Her expertise, patience, and attention to detail made the experience pleasant and simple.

umang shahJune 5, 2024.KATE's dedication and hard work during the house-hunting process were outstanding. The entire process, from our first meeting to moving day, was easy and stress-free. Her expertise, patience, and attention to detail made the experience pleasant and simple. Stephanie SheppardMay 30, 2024.I had the pleasure of working with Karina on securing a rental property, and I can't recommend her highly enough! From the very beginning, she was incredibly helpful and responsive. She answered all my questions promptly and provided clear, thorough information at every step. Karina guided me through the entire process with ease, making what could have been a stressful experience feel seamless and straightforward. Her professionalism and dedication were evident in every interaction, and she truly went above and beyond to ensure everything was taken care of. If you're looking for an agent who is knowledgeable, responsive, and genuinely cares about their clients, I highly recommend reaching out to Karina!

Stephanie SheppardMay 30, 2024.I had the pleasure of working with Karina on securing a rental property, and I can't recommend her highly enough! From the very beginning, she was incredibly helpful and responsive. She answered all my questions promptly and provided clear, thorough information at every step. Karina guided me through the entire process with ease, making what could have been a stressful experience feel seamless and straightforward. Her professionalism and dedication were evident in every interaction, and she truly went above and beyond to ensure everything was taken care of. If you're looking for an agent who is knowledgeable, responsive, and genuinely cares about their clients, I highly recommend reaching out to Karina! Neil PalancaMay 23, 2024.Kate was our leasing agent, and we couldn't have asked for a better experience. From the start, she was incredibly patient and understanding, taking the time to thoroughly explain every step of the rental process. Kate clarified all the details we needed to know and was always available to answer our questions. Her professionalism and friendly demeanor made the entire experience smooth and stress-free. We felt well-informed and supported throughout. Highly recommend Kate for anyone looking to rent a place! Thank you, Kate! 5 stars for you ⭐️⭐️⭐️⭐️⭐️

Neil PalancaMay 23, 2024.Kate was our leasing agent, and we couldn't have asked for a better experience. From the start, she was incredibly patient and understanding, taking the time to thoroughly explain every step of the rental process. Kate clarified all the details we needed to know and was always available to answer our questions. Her professionalism and friendly demeanor made the entire experience smooth and stress-free. We felt well-informed and supported throughout. Highly recommend Kate for anyone looking to rent a place! Thank you, Kate! 5 stars for you ⭐️⭐️⭐️⭐️⭐️ Joy WangMay 15, 2024.We have been with Elevate for almost 5 years, their property management team keeps delivering outstanding service. Especially Laryssa Maneja, she use to be a property manager and then become the head of property management team, now a . She gained lots of knowledge and experience regarding property investment, leasing, tenants profile, renovation over the past a few years. She is knowledgeable, organized and good at communications. Love working with her!

Joy WangMay 15, 2024.We have been with Elevate for almost 5 years, their property management team keeps delivering outstanding service. Especially Laryssa Maneja, she use to be a property manager and then become the head of property management team, now a . She gained lots of knowledge and experience regarding property investment, leasing, tenants profile, renovation over the past a few years. She is knowledgeable, organized and good at communications. Love working with her! Pradip & Raksha BhattMay 8, 2024.A big thankyou to Spiro Vrysellas at Elevate for his excellent & efficient service. Highly recommended and he is with you every step of the way. Made the process seamless.

Pradip & Raksha BhattMay 8, 2024.A big thankyou to Spiro Vrysellas at Elevate for his excellent & efficient service. Highly recommended and he is with you every step of the way. Made the process seamless. Sophie GuilbaultApril 29, 2024.We had a wonderful experience working with Laryssa for the leasing and property management of our home. She has demonstrated great knowledge of the market, creative problem solving and high responsiveness through our entire experience working with her and we couldn’t be more grateful. There are few people I would not hesitate recommending to friends and family when it comes to real estate matters but Laryssa is one of them. I trust that anyone working with her will have a similar positive experience!

Sophie GuilbaultApril 29, 2024.We had a wonderful experience working with Laryssa for the leasing and property management of our home. She has demonstrated great knowledge of the market, creative problem solving and high responsiveness through our entire experience working with her and we couldn’t be more grateful. There are few people I would not hesitate recommending to friends and family when it comes to real estate matters but Laryssa is one of them. I trust that anyone working with her will have a similar positive experience!